Grüezi, crypto enthusiasts! As a self-proclaimed expert with a fondness for Swiss precision – you know, like timing your trades as accurately as a cuckoo clock – I'm here to spill the beans on passive income via Bybit in Canada this 2025. Hoppla, but first a quick note: Bybit faces some restrictions in Canada due to local regs, so always double-check if you can access it legally (maybe via compliant alternatives if not). No funny business, eh? We're talking set-it-and-forget-it strategies: staking, savings accounts, and launchpools that let your crypto work while you sip maple syrup. Let's dive in with analytics, visuals, and a dash of Swiss slang for that extra "Znüni" boost – think mid-morning snack, but for your wallet!

Bybit Earn interface – your gateway to passive yields in 2025.

High APRs: Bybit's USP for Steady, Swiss-Like Reliable Returns

Bybit's Earn section is a powerhouse for passive income, offering APYs that beat traditional banks like a yodeler outsinging a moose. In 2025, flexible savings on USDT hover around 8.28% APR, while BTC and ETH sit at 2.5%. Joke's on fiat: Why did the Canadian dollar break up with crypto? It couldn't handle the high yields! USP here? Zero lock-ins on flexible plans, so you withdraw anytime – perfect for unpredictable markets. Analytics show staking rewards fluctuating but averaging 5-10% on majors like SOL, driven by network fees and inflation.

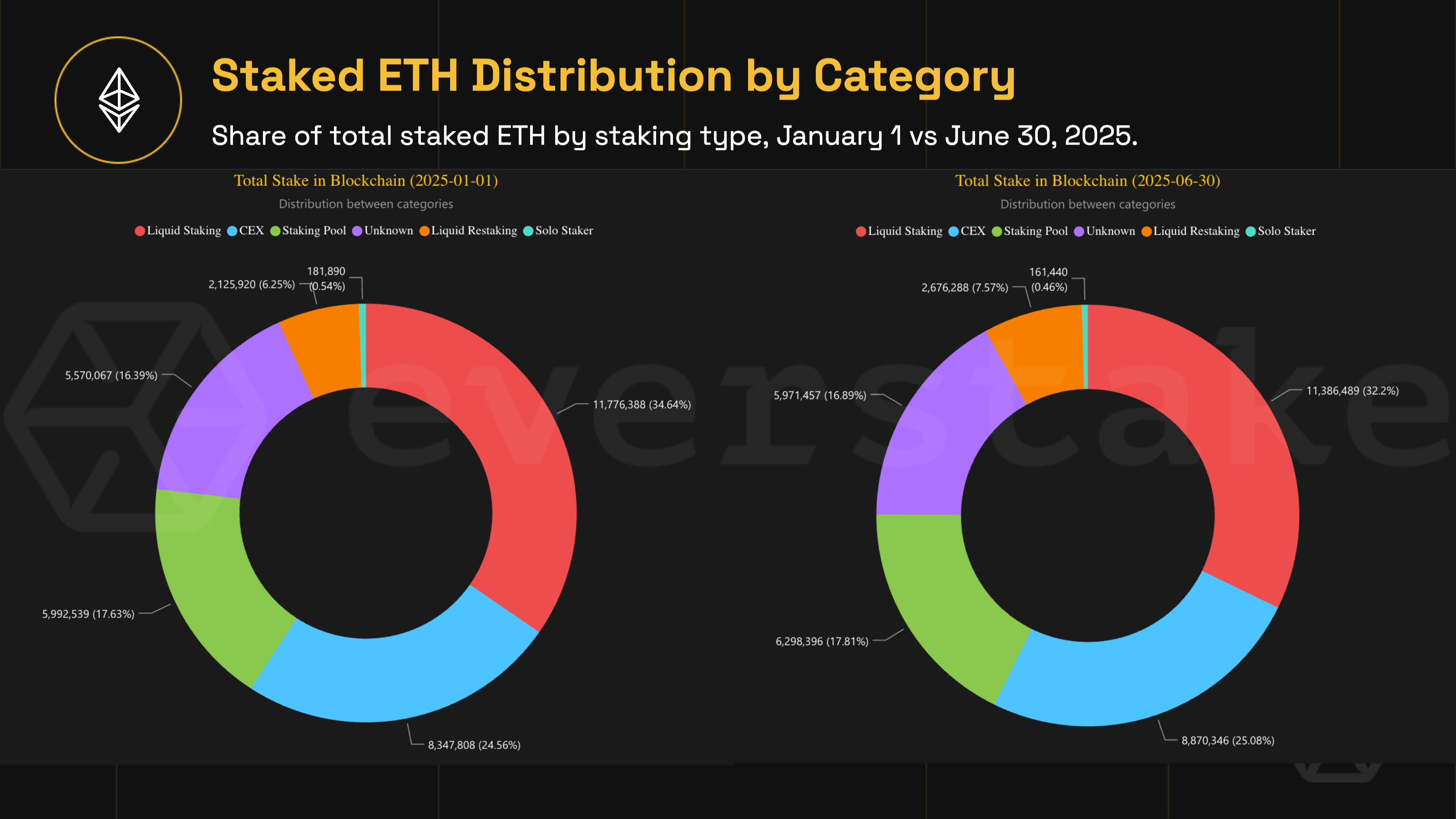

For Canadians, remember CRA taxes staking rewards as income (business or capital gains) – track with tools like Koinly to avoid a "Bünzli" (stuffy Swiss) audit surprise. In 2025, with ETH staking distribution shifting (liquid staking up to 34.6% share), Bybit's on-chain earn hits max 5.71% on ETH.

2025 staking rewards chart – SOL yields peaking with network activity.

DeFi Staking Pools: Bybit's USP for Effortless, High-Risk-High-Reward Mining

Hoppla, want more excitement without day-trading? Bybit's DeFi Staking Pool lets you stake assets like ETH or stablecoins for effortless earnings. USP: Managed staking simplifies the tech – no need to run nodes yourself. In 2025, expect yields up to 10% on wealth management plans (3-30 days), but watch for volatility. Analytics from mid-2025 show meme-driven booms lifting yields 2% in days.

Canadian twist: DeFi income might trigger capital gains if disposed, per CRA guidelines. Joke time: Staking on Bybit is like Swiss chocolate – smooth and rewarding, but overindulge and you'll feel the melt! Pro tip: Diversify across BTC, ETH, and USDT for balanced passive flow.

Launchpool rewards in action – stake to earn new tokens like 0G.

Launchpools & Promo Events: Bybit's USP for Bonus Tokens and 2025 Boosts

Bybit shines with Launchpools – stake BNB, MNT, or others to snag shares of new tokens, like 100K 0G pools. USP: Greater flexibility and faster rewards in 2025 updates, with events like Earnival offering up to 555% APR promos (May-Jun). Analytics predict passive earners grabbing 10-20% extra via these, especially with Bitcoin adoption rising.

In Canada, shelter returns in TFSAs via ETFs if Bybit's out – 15 options available in 2025. Swiss slang alert: This is your "Rösti" – golden and crispy rewards without flipping burgers! But DYOR; volatility can turn profits into a "Chuchichäschtli" (tongue-twister mess).

ETH staking distribution analytics for 2025 – liquid options dominating.

Analytics Wrap-Up: 2025 Projections and Tax Savvy for Canadians

Crunching 2025 data: Passive crypto yields average 5-15% on Bybit, outperforming tradfi but with risks. ETH staking grew 7.5% in H1, with pools like Bybit's capturing more via liquidity mining. For Canada, new draft laws on CCPCs affect passive income taxes – report accurately to stay compliant.

Final joke: Why do Swiss love Bybit staking? It's as neutral as our politics but yields positive vibes! Start small, monitor, and merci vielmal for reading. If restricted, eye alternatives like Binance or Kraken. Tschüss!